Opening the Advantages of Employing a Loss Assessor for Your Insurance Policy Claim Examination

When encountered with the complexities of filing an insurance policy case, the decision to enlist the services of a loss assessor can considerably influence the outcome of your analysis. By using their expertise, you not just expedite the case negotiation procedure however additionally ease the stress and anxiety and inconvenience generally associated with insurance cases.

Competence in Insurance Plan

With a deep understanding of insurance plan, a loss assessor can navigate the complexities of insurance coverage terms and problems to optimize your insurance coverage case. Loss assessors function as advocates for insurance holders, leveraging their competence to interpret the small print of insurance policy contracts. By very carefully examining your plan, a loss assessor can figure out the extent of coverage readily available for your specific circumstance, ensuring that you get the settlement you are qualified to.

Furthermore, loss assessors remain updated on the most recent adjustments in insurance regulations and policies, enabling them to give educated assistance throughout the insurance claims process. Their experience with industry-specific terminology and techniques furnishes them to effectively communicate with insurance provider in your place, expediting the resolution of your case. This level of efficiency in insurance coverage policies establishes loss assessors apart, enabling them to identify potential voids in coverage, analyze the worth of your claim properly, and work out with insurers masterfully to achieve the very best possible end result for you.

Accurate Case Evaluation

Having actually established a robust structure in analyzing insurance plan, a loss assessor's next vital job entails conducting an exact assessment of the insurance policy claim. This process is essential in making certain that the insurance policy holder gets fair compensation for their losses. Precise claim assessment needs meticulous attention to detail, thorough investigation, and a thorough understanding of the details of the insurance coverage.

A loss assessor will evaluate the extent of the damages or loss incurred by the policyholder, taking right into account numerous aspects such as the terms and problems of the insurance coverage, the worth of the property or assets influenced, and any kind of extra expenditures that may have occurred as a result of the case. By carrying out a precise assessment, the loss assessor can identify the suitable quantity that the insurance provider ought to pay out to the insurance holder.

In addition, an accurate insurance claim assessment can aid accelerate the claims process and avoid disputes in between the insurance policy holder and the insurance policy firm. By engaging a loss assessor with competence in precise insurance claim evaluation, policyholders can navigate the claims procedure with confidence and guarantee a prompt and reasonable resolution.

Arrangement and Campaigning For Skills

When engaging in settlements, a skilled loss assessor can leverage their experience to navigate complex claim treatments, examine damages accurately, and provide a compelling situation to the insurance coverage company. By promoting for the policyholder's benefits, a qualified loss assessor can help ensure that the insurance provider provides fair payment that straightens with the policy terms and the actual losses incurred.

Moreover, strong negotiation abilities allow a loss assessor to address any type of disputes or inconsistencies that may develop during the claim evaluation procedure effectively. Via critical campaigning for and arrangement, an experienced loss assessor can help policyholders protect the Get More Info payment they rightfully should have, offering comfort and economic alleviation in difficult times.

Faster Case Settlements

An efficient loss assessor facilitates expedited case settlements through structured procedures and aggressive communication with insurance business. By leveraging their knowledge in browsing the intricacies of Continue insurance policies and insurance claims treatments, loss assessors can assist accelerate the settlement process for insurance holders.

Loss assessors are well-versed in the documentation required for insurance claims and can make sure that all necessary info is immediately sent to the insurance policy company. Technical Assessing Australia. This positive technique lessens hold-ups and accelerates the examination of the claim, resulting in faster settlements

Moreover, loss assessors possess a deep understanding of the valuation of damages and losses, allowing them to accurately assess the extent of the case and bargain with the insurance provider in behalf of the insurance policy holder. Their capability to provide a extensive and well-supported claim can dramatically quicken the settlement procedure.

Lowered Stress and Hassle

Dealing with insurance policy claims can be frustrating, specifically when faced with the details of plan wordings, paperwork needs, and negotiations with insurance coverage firms. By enlisting the services of a loss assessor, people can unload the worry of managing the insurance claim procedure, permitting them to focus on other concerns without the included visit the website stress and anxiety of dealing with insurance companies directly.

Additionally, loss assessors have the proficiency to examine the complete level of the loss properly, ensuring that insurance policy holders get ample and reasonable compensation for their claims. This knowledge can assist enhance the insurance claims procedure, minimizing hold-ups and lessening the back-and-forth commonly entailed in case negotiations. Inevitably, by employing a loss assessor, people can experience a smoother and less difficult insurance policy case procedure, allowing them to navigate difficult situations with confidence and assurance.

Verdict

To conclude, working with a loss assessor for insurance coverage claim assessment can offer valuable proficiency in insurance plans, precise evaluation of claims, arrangement and campaigning for skills, faster claim negotiations, and decreased tension and hassle for insurance holders. Loss assessors Australia. Their expert guidance can make certain a prompt and fair resolution of insurance policy claims, ultimately profiting both the insured celebration and the insurer

By utilizing their know-how, you not only quicken the insurance claim settlement process but likewise reduce the stress and anxiety and trouble typically connected with insurance cases.

Christina Ricci Then & Now!

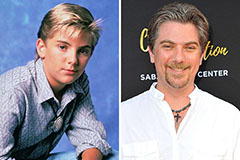

Christina Ricci Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!